- Access to a RIB account.

- SEPA transfers.

- Access to Tontines as a Participant and/or Tontine manager.

- Cash deposit in a network of points of sale in France and Belgium.*

- A physical payment card (home delivery within 10 days).

- International transfers (coming soon).

- Cash withdrawals from ATM.

- Automated currency management.

Account Benefits:

*Conditions of the offer:

*Price includes VAT for an annual subscription, available only in Europe

(France, Belgium, The Netherlands and Luxembourg).

An initial deposit of €5 will be required for the first account opening. This will be immediately available in your account.

Frais de services

- Annual set-up fee for Diaspo services (Including maintenance costs): 40€*

- Minimum deposit: 5€

- Diaspo in/out: Free

- SEPA In: Free

- SEPA out: 0,35€ per transaction

- Cashin MoneyTrans POS: 2%

- Credit/Debit Cards: 1%

- Tontine management fees: Minimum 2.5%

- Withdrawal fixed costs (excluding cost price according to country):

- 1. Europe 2€ per transaction.

- 2.International 5€ per transaction.

- MoneyTrans POS Withdrawals Transaction: 1,5€

- Lost card: Per card: 9€

- New pin letter via La Poste: 2€

- SEPA anomaly (e,g.: rejection/recall = excluding external cost at cost price): Event: 5€

- Judicial or fiscal requisition: Requisition: 10€

- ATD (Avis Tiers détenteur) or OTD (Opposition Tiers détenteur): ATD or OTD: 25€

- Seizure by Bailiff: Seizure: 30€

- Treatment for proven fraud: Fraud: 30€

Limites de retrait

ATM: 500 EUR / 30 days

At a branch: 300 EUR / 7 days

Payment limits

Shops, online: 2.500 EUR / 30 days

Cash deposit limits

At a branch: 1500 EUR / 30 days

Account recharge limits

By card or bank transfer: 10.000 EUR / 30 days

Limits on outgoing transfers

National or SEPA: 10.000 EUR / 30 days

Latest Blog Posts

Find our news dedicated to DiaspoApp.

Aubin NkangaOctober 20, 2024

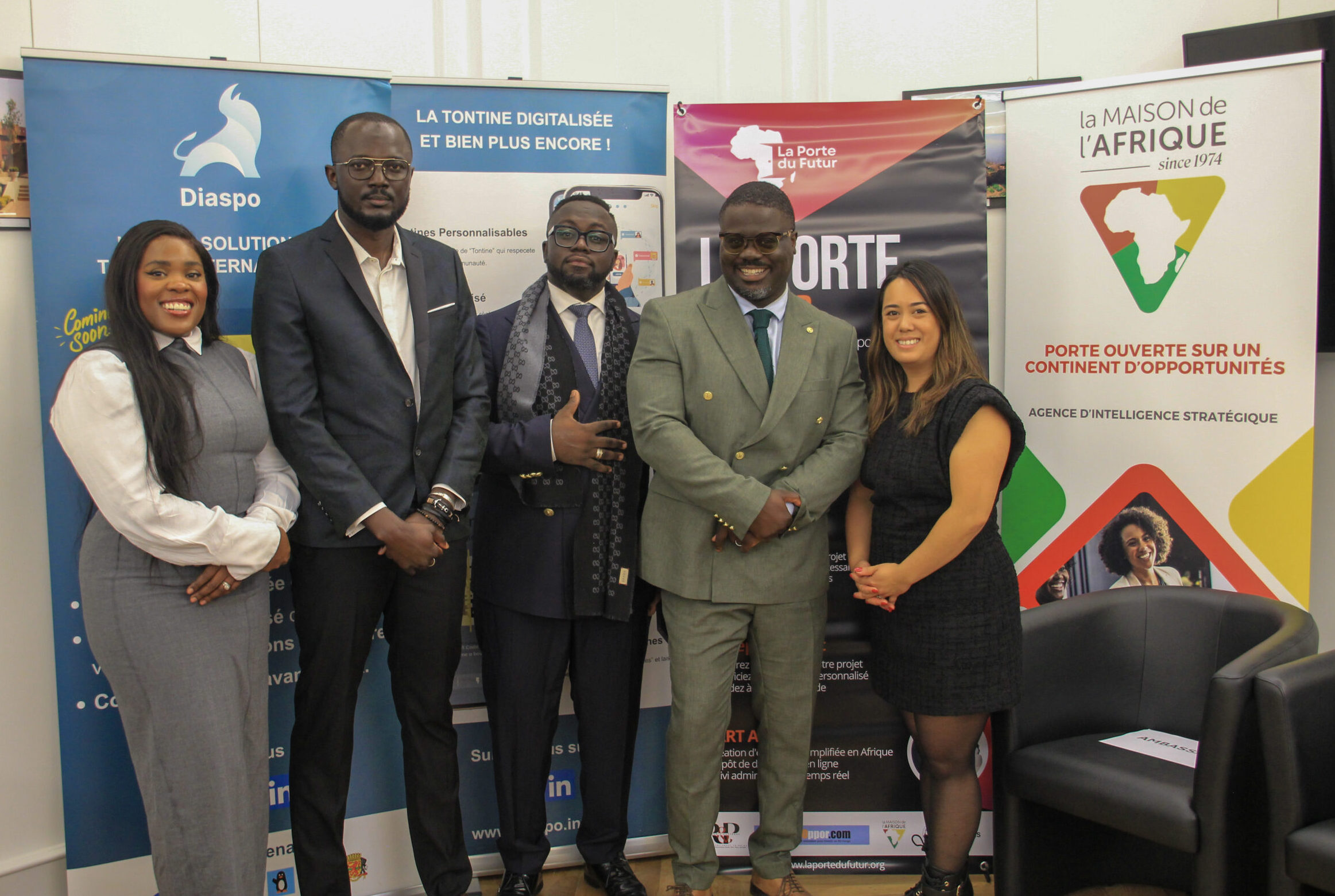

Diaspo : une Aventure Humaine au-delà de la Fintech

17 Octobre, 2024

Read MoreAubin NkangaJuly 25, 2024

Diaspo au Village Africain pour les JO de Paris 2024

25 Juillet, 2024

Read More