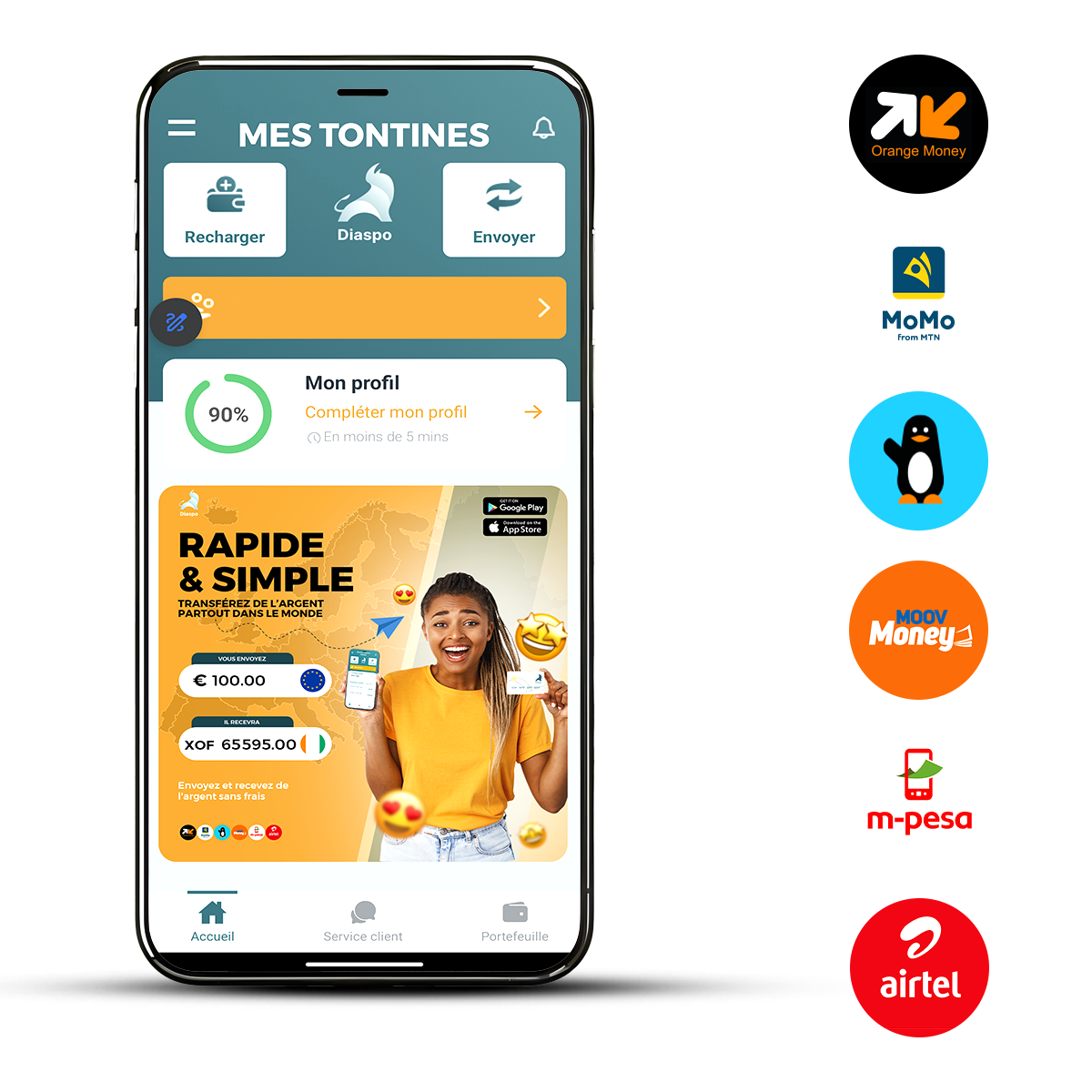

Un portefeuille numérique simple et sécurisé.

Gérez et suivez vos transactions en ligne. Utilisez votre IBAN pour payer vos factures, recevoir ou envoyer des paiements.

Transferts d'argent internationaux simplifiés

Envoyez de l'argent d'un compte Diaspo à un autre, vers des banques, ou des comptes mobile money tels que Wave, MTN, Orange...

Communautés et Tontines Digitales

Gérez efficacement vos cotisations et profitez de la transparence offerte par Diaspo. Vous pouvez désormais financer vos projets ou épargner via votre propre communauté

Votre carte de paiement pour une totale liberté financière

Effectuez des achats en ligne ou en magasin, retirez de l'argent et gérez vos dépenses. La carte Diaspo offre une solution flexible et fiable pour toutes vos transactions quotidiennes

Votre compte digital Diaspo avec une carte de paiement

Un compte digital sécurisé

Diaspo propose des solutions financières efficaces et conviviales, alimentées par une technologie de l’information de pointe.

IBAN

Bénéficiez des avantages d’un IBAN européen via Diaspo. Envoyez, recevez et demandez de l’argent rapidement et facilement

Paiements instantanés et sécurisés

Une carte de paiement sécurisée, universellement fiable et acceptée pour toutes vos transactions.

Transfert d'argent international vers 40 pays

La Tontine dans votre poche

La tontine digitale de Diaspo est conçue pour être simple et facile à utiliser, permettant aux utilisateurs de participer sans effort aux cercles d'épargne traditionnels. En quelques clics, vous pouvez rejoindre ou créer une tontine.

Diaspo offre un moyen de surveiller et de gérer les activités de votre groupe d'épargne. Grâce à des mises à jour en temps réel et un suivi transparent, vous pouvez facilement superviser les contributions, les paiements et la participation des membres.

Dépôt initial de 5 euros

Profitez de toutes nos fonctionnalités : Compte sécurisé, carte de paiement, transferts d'argent internationaux, tontines & services communautaires

Créez votre compte et commencez à utiliser Diaspo

1. Inscrivez-vous

Téléchargez l'application sur App Store ou Google Play et inscrivez-vous avec vos informations personnelles

2. Vérifiez votre identité

Téléchargez vos documents et effectuez facilement la vérification

3. Activez votre compte

Choisissez votre forfait et approvisionnez votre compte

4. Profitez des services Diaspo

Votre compte et votre carte de paiement ainsi que les services de transfert d'argent et de tontine digitale

"Diaspo'' : Votre application financière tout en un !

La volonté de la communauté de se renforcer

Téléchargez Diaspo et obtenez votre premier mois gratuit

Avec Diaspo, vous disposez d'un compte bancaire européen ainsi qu'une carte de paiement sécurisée et vous pouvez transférer de l'argent à l'international et participer à des tontines digitales.

"J'aime la façon dont Diaspo combine les outils financiers modernes avec les pratiques traditionnelles comme les tontines. Je peux désormais envoyer mon argent directement sur les comptes Mobile Money de mes parents"

Robert Tagro

Enseignant"J'aime la carte de paiement Diaspo. Elle est parfaite pour un usage quotidien et offre la sécurité dont j'ai besoin pour les transactions internationales."

Amadou S.

Comptable"Le service de transfert d'argent international de Diaspo est fiable et rapide. Je ne m'inquiète plus des retards ou des frais élevés, ce qui en fait mon choix privilégié pour envoyer de l'argent à l'étranger."

Diarassouba N.

Commerçant"Nous avons désormais une application communautaire qui nous permet d'économiser, de suivre nos tontines et d'envoyer de l'argent chez nous"

Kouamé S.

Ingénieur